Registration Certificate

Ettukkai Holdings Private Limited was incorporated with the Registrar of Companies, Tamil Nadu, Chennai on 9th October, 2018 with the object of registering the Company as an NBFC-ND-Type II-Loan Company

On 11th February, 2020 Ettukkai Holdings Private Limited was granted the Certificate of Registration to commence/carry on the business of non-banking financial institutions. The directors of the company are

Mr. Duraisamy Palanisamy is the Designated Director and Mrs. Thamilarasi Duraisamy is the Principal Officer of the Company.

Ettukkai Holdings Private Limited shall offer long term and short term financial packages to industrial enterprises ranging from corporate to MSMEs.

Ettukkai Holdings Private Limited shall offer the following financial offerings:

“MSME Credit” will be a Financial Product focused on MSME Units and Entrepreneurs. The promoters have been dealing with numerous MSMEs all along. Understanding the financial needs of MSMEs, Promoters have started the NBFC to full fill the financial needs of MSMEs and create a Financial Service Vertical for the “Intech Group”.

In addition to MSME Credit, the NBFC has the opportunity to do Mortgage Loans, which are more of a personal loan in nature. The group companies of the Promoters have been employing hundreds of employees whose financial needs can be met by the NBFC.

Equipment Leasing is to facilitate the use of machinery, vehicles or other equipment on a rental basis for the customers avoiding the necessity to invest capital in equipment. Ownership rests with the NBFC while the Customer has the actual use of it.

All the Financial Products MSME Loans, Mortgage Loans ML, Employee Loans EL will be designed as Equated Monthly Installments [EMIs] on Monthly Reducing Balance method. Rate of Interest which the NBFC can offer would be about 18% based on the adequacy of security and risk profile of the customer.

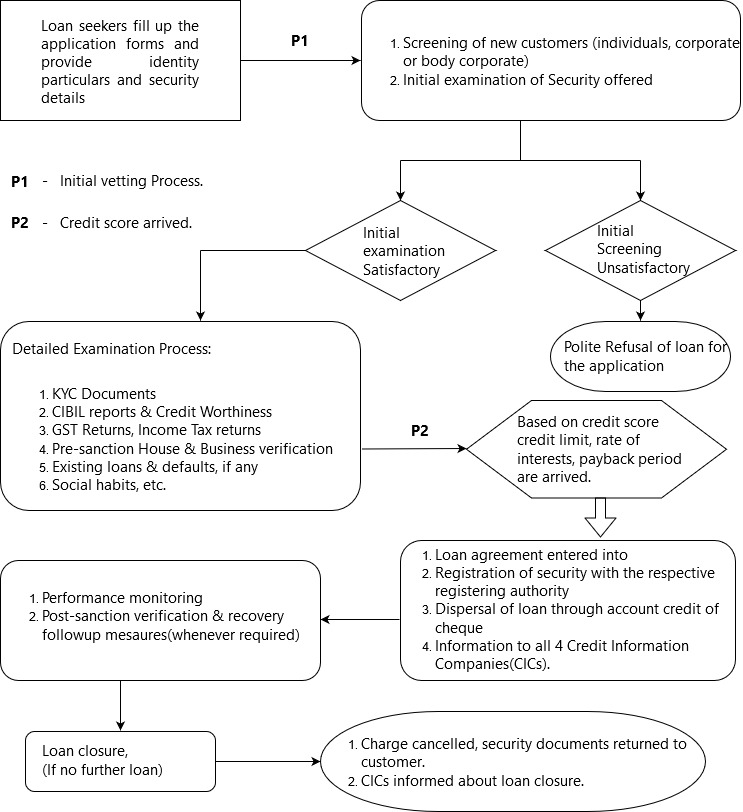

As per RBI norms we have taken membership with the four CICs (Credit Information Companies)...

CIBIL

Equifax

Experian and

CRIF High Mark

| # | Particulars | Details |

| 1 | CIN No | U65990TN2018PTC125198 |

| 2 | PAN No | AAFCE2215D |

| 3 | TAN No | CHEE07659B |

| 4 | GST No | 33AABCI0806J1ZZ |

| 5 | RBI CoR No | N-07-00857 Dt:11/02/2020 |

| 6 | Company Name | Ettukkai Holdings Private Limited |

| 7 | Address | S-2, Guindy Industrial Estate |

| 8 | Area | Guindy |

| 9 | City | Chennai |

| 10 | Pin Code | 600032 |

| 11 | Mail ID | nbfc@8kh.in |

| # | Title | Bank Details |

| 1 | A/C Holder Name | Ettukkai Holdings Private Limited |

| 2 | Bank | ICICI Bank |

| 3 | Branch | Guindy, Chennai - 600032 |

| 4 | A/C No | 410205000247 |

| 5 | IFSC Code | ICIC0004102 |